Actually, my take on “money” is a bit orthodox… I’m not a great fan of Gold, much like Hayek. [And by Gold, I mean Bitcoin, Eth, and its great many tokens that build value from demand of the “currency”/“money” itself. All the classical Austrians mostly used the term “money”; in fact, Hayek even used the word “monies”; haha! But these days, “currencies” is often used interchangeably…] Anyway, back to the subject. I believe they (Golden “monies”) are surely better than government money, but we can do a lot better than that. In fact, that’s what Hayek wrote extensively about in his later works on Money.

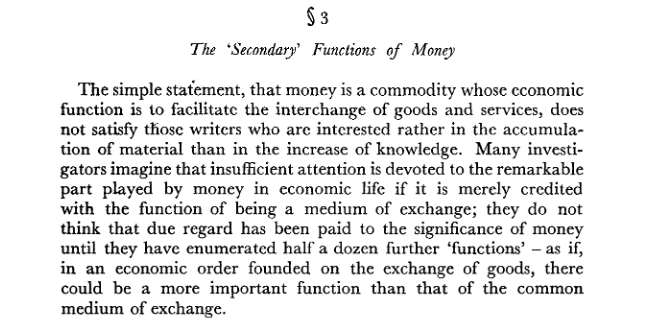

Anyway, Mises, in his monograph “Economic Calculations in a Socialist Commonwealth”, defines money somewhat this way:

… calculation by exchange value makes it

possible to refer values back to a unit. For this purpose,

since goods are mutually substitutable in accordance with

the exchange relations obtaining in the market, any possible

good can be chosen. In a monetary economy it is

money that is so chosen.

He goes on to say a lot of interesting things about monetary calculations (page 31, if you are interested in the context; here at https://cdn.mises.org/Economic%20Calculation%20in%20the%20Socialist%20Commonwealth_Vol_2_3.pdf).

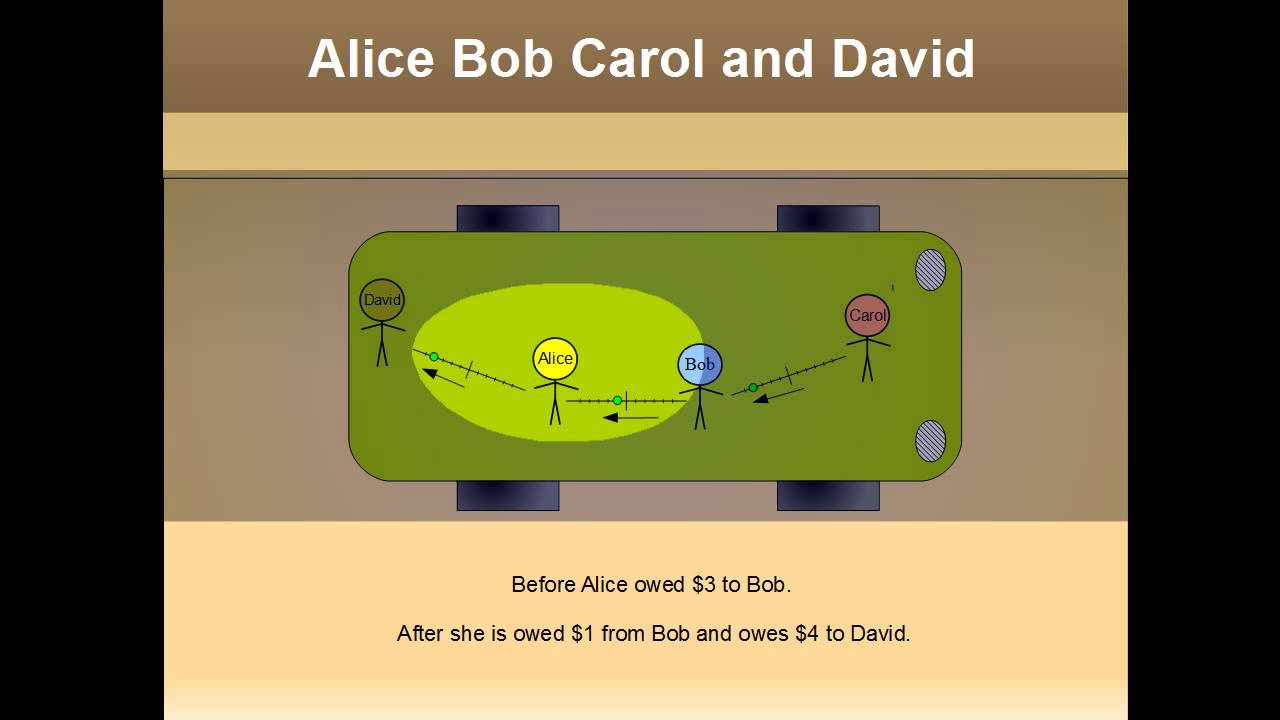

The second condition is that there exists in fact a

universally employed medium of exchange—namely,

money—which plays the same part as a medium in the

exchange of production goods also. If this were not the

case, it would not be possible to reduce all exchange-relationships

to a common denominator

Hayek expands on it and concludes that there can and rather must be multiple such denominators, competing with each other, under which condition each has sufficient motives to shield itself from inflating its relative price thereby shielding itself from diminishing its purchasing-power; basically, that even “monies” should be produced on the free market, and that there’s no reason to think why such monies would be any worse than Gold itself!

[https://groups.google.com/u/3/g/rippleusers/c/3RABIJDzE1o; that’s where my quest (or rather, obsession) with Money landed; see if you like it…]

Anyway, these views are orthodoxical because the mainstream belief on Holochain forum on this subject (mainly, Arthur Brock’s bets regarding money) is that money is ‘currency’, which is something that flows from one participant to another, and that every use-case demands a different currency-design. I call that take absolutely ridiculous!

A “currency” that has a built-in expiry-date, or that has a transaction-cost associated with it, or has some other weird behavior, surely is something, but that something is not “money”! Period! [At least in the ‘economic’ sense of the word.]

Sure, “goods” do carry such weird behaviors, but a representative-money (i.e., a token that represents its underlying asset) cannot have those absurdities; surely, its relative price (i.e., the price of that token or currency) will reflect those underlying issues, but through its relative price alone; no further! But they never seemed to understand that argument…

Firstly I think when it comes to “money”, listening to those who penned their thoughts about it before things like the internet were around is useful however we do have the internet, the world is different, more so than anyone “back in the day” could’ve imagined. It is OK for us to adapt our thoughts based on progress and the changes that have happened.

Firstly I think when it comes to “money”, listening to those who penned their thoughts about it before things like the internet were around is useful however we do have the internet, the world is different, more so than anyone “back in the day” could’ve imagined. It is OK for us to adapt our thoughts based on progress and the changes that have happened.