and others allow you to go into a negative balance only if they think you’ll be able to pay it back or if they can hold it over your head somehow, or if they want to just be nice and clear the debt. In Ripple, a 15 year old system, you are always in a “trade deficit” until you have managed to clear the IOU. Your comment about that Ripple (multi-hop mutual credit) somehow “puts Zambians into a global trade deficit” is nonsense. as I already said, the “deficit” is a fiction, you deliberately allow someone to go into more debt than they can get back because you know you can exploit it.

Sorry I didn’t read the full doc. It would have been much more than 3 minutes for me.

When I said coincident, I didn’t state any causality. You stated causality when you you asserted that fiat money caused a misallocation of resources. We couldn’t possibly know what fiat money caused, because you can’t disentangle the notion of fiat money from capitalism, from power, from the energy glut, from technological advances, from the petrodollar agreement and US hegemony, and from all the alternative histories. All you can say in a short comment is that the two phenomena were coincident.

Please also note that in one short post, you have flatly contradicted me, made the same error you accused me of, implied that you are years more advanced than me and concluded with a patronising remark. You said earlier.

Don’t know (yet) as to how to reformulate sentences so as to make them sound more friendly…

Here are some tips:

Instead of ‘false. totally false’ which sounds like how about ‘I don’t understand why you say that because…’

instead of “I can’t convince you” or “your heart knows the truth”, how about “I don’t have space/time to get to the bottom of this right now”, or “would you like to discuss this key point to find where we disagree”.

instead of “we would have had flying cars by now” how about "I believe that social technological progress have been retarded overall "

Instead of "you made a logical fallacy, how about “it seems to me that there is a logical fallacy here”

Instead of “clearly I can’t convince you” which implies that I refuse to listen to the voice of reason, how about “can you link me to more information on this”.

All right, I’m triggered and I’ve now spent more time than I intended trying to be helpful.

I’ve had enough of your rudeness too.

Over and out.

I haven’t been rude to you. Multi-hop mutual credit is 15 years old. If you want to go in and attack it based on that it does not work with macro scale trade, it does, so it isn’t true. And what I said about payments is true, otherwise it isn’t a payment but a gift. Even with temporary “deficits”, Ripple only stores any credit balances when there are temporary deficits, otherwise they are cleared. It consists only of “trade deficits”.

Hi dear Matthew,

It takes my effort and time too… I’m deeply depressed to say that I won’t be available for chat on this forum for a month now.

Before I go away, one more thing. It gives my heart warm satisfaction and relief in pointing you that in asserting the following:

you may be wrong there. You see, there’s this thing called “praxeology”, the aprioristic science that our God Mises blessed us with. You may benefit from checking it out. Again, you may be right; I’m not saying in any way that I know better. I clearly am much less experienced than you. So not giving you any advice; just sharing an observation I made which made me realize how much we previously thought to be indecipherable can be deciphered with the right mental tools.

Also, I’d beg that you reconsider whether we have been rude to you and whether the rudeness of an opponant is sufficient to establish that one’s argument is right. Again, I can be wrong. Perhaps rude people should be condemned to hell, as an extreme case. [Haha!]

Thank you.

Sincerely yours, and yours alone [Haha!],

The A Man

Addressing some real genuine concerns (which I couldn’t have addressed some months ago) [cc @MaxxD],

I don’t buy that argument at all. It runs into itself. No idea why some of the prominent Austrians assist that this is true. Jefferey’s assertion that Bitcoin is valuable (in and of itself) because of the utility of the payment network that it is, is in my understanding cyclical. Sure, there’s no arguing over why and how the price of Bitcoin rose (the Regression Theorem explains it perfectly), the origin story remains a mystery. In my opinion, in the early days of that network, it simply gave people joy (as in removing some felt uneasiness) in possessing coins of a novel crypto network that was the product of so many isolated yet connected developments in the computer sciences. However, I don’t think that that holds true anymore. Back then, paying a dollar for this Bitcoin thing would often put a smile on the tech geeks who could appreciate the work of ingenuity that it was. However, I don’t think that owning Bitcoins is anymore associated with that feeling; plus most people (especially corporate investors and banks who’re swimming in it these days) don’t have the technical prowess to appreciate its ingenuity. Gold never loses its value as a commodity; a Gold ring on your finger would never cease to look pretty. Even setting aside individual value judgments about what’s beautiful and what isn’t, there will always be those who find it pretty. One can say that with Bitcoin too, that there would always be programmers who find Bitcoin “beautiful”. But even that’s shifting; for instance, Holochainers already find Bitcoin “ugly”, a work of “naivete”. Press (including our own Art Brock) is already fuelling this idea that Bitcoin is not eco-friendly, that it should be looked down upon with disgust (and rightfully so, in my opinion). As far as I know, no one (as of yet) says that a Gold-laden woman looks ugly, that Gold jewelry feels disgusting, that Gold causes cancer (haha!), that a gilded decoration makes a mansion sell for cheap. In fact, science has already established that Gold is truly rare, that its formation requires stars to explode (or dead stars to merge, or whatever), that in the periodic table there’s no element like it, and even that we’d never be able to fuse Hydrogen atoms to reach at Gold feasibly, and especially that there’s no hope to find a new metallic element in the higher (unexplored) orders of atomic masses (element 115 (dubbed “Vril”) is an exception though; haha!). We already have found other (and in most cases, “better”) cryptocurrencies. There’re already thousands of cryptocurrencies that can substitute Bitcoin and be better, faster, and more efficient while doing so. The most important argument that truly tilts the scale in Gold’s favor is that of its industrial usage. Bitcoin is left speechless at this point.

In my opinion (and this is no financial advice), to put it mildly, Bitcoin doesn’t have a bright future. The value of Money that is due to its use as a medium of exchange vanishes beautifully when it is no longer deemed as a good enough medium of exchange, or when the society no longer wishes to exchange (as in people constricting their cash holdings). With Gold, I don’t see why that might ever happen in the foreseeable future. And even if it did ever happen, Gold would never drop to zero. However, with Bitcoin, when that drop comes it will be as rapid as was its rise. Most knowledgeable investors already consider Bitcoin to be a speculative bubble. Though in the short term, it might appreciate like hell if fiat crashes before Bitcoin! Haha! Mises never said anything on what might happen should a neutral money rise to dominance; in my opinion, when the time comes (and when they can figure out a means to do so), Bitcoin hodlers would rightfully choose to flee to real Monies (perhaps the Secondary Media of Exchange), taking the Bitcoin price (to plunge) with them! Every Bitcoiner is looking for an exit strategy, no? It’s just that there’s none as of now.

By the way, in Vril, there’s this concept of “thank-you” tokens (i.e., NFTs) that function very much like Bitcoin except with a twist. For instance, Newton might issue a million “Gravity Tokens” that express Newton’s gratitude to the beholder for owning those tokens and express appreciation for their act of holding those tokens as a contribution to the development of his theory. Furthermore, when implemented as a ‘Vril contract’, it would be certain that no new tokens that bear this note get minted. Those tokens would be safe-as-hell (and in my opinion, more resilient than Gold itself), at least as long as prime-factoring (that’s at the heart of the public-key cryptography) doesn’t get “figured out”. No one has even proved whether the problem of prime-factorization is not NP-complete (most agree that it’s NP-hard at the very least), let alone “crack” it. And no, quantum computers are NO threat to it whatsoever. In a sense, this truth (that yet has to be established as formal proof) that some problems will never be easy to solve is more comforting than the truth that creating Gold out of fusion (i.e., out of thin air) would never be possible on a reasonable scale. Moreover, you can always (if you’re lucky) find Gold on other celestial objects. Cryptography doesn’t suffer this problem. However, such “thank-you” tokens can potentially lose their utility as a commodity. Newton’s “Gravity Tokens” would have a hard time when Einstein shows up, writes his theory, and issues “Relativity Tokens”.

Anyway, such thank-you tokens are the closest kin to Blockchain Tokens that I could find in the Holochain space. I hope it ticks your mind into wandering.

Then, one may reasonably ask, what on Earth are Holochainers building in this “fintech” space (don’t like the word ‘cryptocurrency’; even Nakamoto never used that word as far as I know; fintech sounds reasonable)? Again, the officials have utterly failed to convince sound and logical people. Though I can’t speak on Holochain’s behalf, I would be able to on Vril’s.

As a side note, Hoppe confused liberty rights with claim rights in his Ethics of Argumentation (a book that he hasn’t published YET, partly because of the same). Anyway, you’re right. At least historically, the most marketable Money became the dominant one always. However, it’d be wrong to use the word ‘inefficient’ there; the use of many Monies would not be ‘inefficient. The most one can say is that the use of many Monies would collapse into the use of just one of them (whichever is the most marketable among them all). Economic calculation is always bound to have “arbitrary” “inefficiencies”; arbitrary as in the sense, arbitrary changes in profits and losses induced not by genuine profits and losses but by changes in the purchasing price of the Money concerned. Such changes are present there ALWAYS, be it when only one Money is being used (in the society) or more than one. One must never forget that the price of Money (in terms of other goods and services in the economy, for example, 4 toothbrushes per Dollar) is also a result of its (the Money’s) supply and demand. Those so-called ‘inefficiencies’ in economic calculation induced by changes in Money’s supply and demand, and allegedly more vehement changes in the many Monies’ supply and demand, can never do done away with. The emphasis is on Demand here. Supply can be stabilized if the Money is backed. Money’s Demand depends on a gazillion factors; roughly speaking, Money’s demand is a function of whether people wish to trade, and I don’t expect vehement changes in that. As for the changes in the valuations between different Monies (and the Monies I’m talking about are the Secondary Media of Exchanges, which are just as good enough a Money as Gold in my opinion) who knows! Rephrasing as “would multiple Monies lead to more vehement changes in ‘arbitrary’ profits and losses”, it depends on:

- Whether the multiple Monies are in an ongoing ‘network-effect’ war with each other, which further depends upon:

- Whether there does indeed exist differences in the marketability of those Monies, and

- Whether such differences can be universally identified, which is only the case when

- Those differences are not “subjective”.

Noone would argue over the superior imperishability of Gold compared to that of a burger. But on a debate on the imperishability of Apple stocks vs Tesla stocks, no consensus could feasibly be reached. As for corporate stocks, asset-backed securities, etc, Mises has argued that they qualify as suitable ‘Secondary Media of Exchange’. Read my 3-minute article for more. Emphasis should be on the word ‘Media’ (plural) there. As opposed to ‘the one Money’, the Secondary Media of Exchange are neither singular nor permanent; they come and go, they’re transient. If it all sounds unconvincing, that’s because Money, unlike most other catallactic categories, does not have a strong definition in praxeology. But what been said on it (at the expense of a few sacrifices in the strict axiomatic approach due to the addition of some assumptions) is still the only most sane tool with which to understand the emergence of money. Such an understanding dictates that if it were not for the objectively inferior marketability of most goods in most dealings, Money as we know it (Gold and Silver) would never have arisen. You can’t pay a cobbler with Tesla stocks! If something challenges this reality, it challenges Money (Gold and Silver). I see Holochain Vril as challenging this assumption that you need cash (Gold and Silver) for any purpose whatsoever, especially for trading in indirect exchange. Without going technical, I believe the future is that of the Secondary Media of Exchange. Furthermore, the way Vril has been architected, one can say that the future is of Indirect Indirect Indirect Exchange, as in you won’t be acquiring Gold to not consume but be later exchanged with, as in this case, the cobbler, so as to get your shoe polished. You’d rather be ‘holding’ Tesla stocks (oh no, not them! Haha!) among other things, as a generalized example. Again, you do not ‘hold’ Gold, you just ‘keep’ it; ‘holding’ most Secondary Media of Exchange bestows you with gains (not just ‘apparent’ gains) as is the clearly visible case with dividend-paying stocks. Also, in this context, in Secondary Media of Exchange I’m being generic enough to include all sorts of financial products and assets; sure there are differences between the two, but for this context, those differences don’t matter. What matters here is the discrimination between ‘The Money’ and ‘The Secondary Media of Exchange’. Anyway, when asked to pay the cobbler, you take a tenth of a Tesla stock and automagically convert it into Starbucks’ Coffee Tokens, something that the cobbler would accept as payment. This automagical conversion, or rather, translation of tokens of one kind into another would simply not have been possible had it not been for the superior efficiency of Holochain in carrying out such a rippling path-finding algorithm. Now, of course not all Money is created equal; the top stable corporate stocks, relatively safe financial instruments, and indexes, would undoubtedly be AAA-rated Monies (i.e., your go-to choice for long-term holding), with Starbucks’ Coffee Tokens being on the lower side of the scale. With seamless translation between the two ad-hoc, Secondary Media of Exchange become not so ‘Secondary’.

Addressing your minor issues,

Since you seem to be familiar with UniSwap, a few notes for you. Though I’ve never programmed (let alone managed) ERC tokens, my understanding is that UniSwap is not a rippling exchange (something that Vril takes pride in being). UniSwap relies on liquidity pools of pairs of tokens (of “socks”; haha!); it works great for a few thousand tokens. As I emphasized earlier, when it comes to the Secondary Media of Exchange (something that Vril is deeply interested in powering), no such token enjoys universal recognition/acceptability. On the Ethereum ecosystem, however, the token Ether enjoys almost universal recognition and it is what most tokens provide liquidity pool against. But as an extreme case, imagine 26 tokens (A to Z): if A can be exchanged for B, B for C, and so on, then on Vril you would need consecutive possession and exchange of at most 25 of such media of exchanges (i.e., such tokens); on UniSwap however, you’d need a 25 + 24 + 23 + (and so on) number of liquidity pools so as to provide seamless and fast liquidity between any and all two of such tokens (unless you can batch consequent swaps on the client, something that’d require you to know the relevant sequence of such swaps that can lead you to the final token; something that’s built-in into Vril). Metaphorically, UniSwap provides liquidity whereas Vril is liquidity.

Anyway, as for your concern that people will, at least in group conversations, tend to stick to just one Money, only time will tell… I personally think against so. Hell, even language can be translated in real-time, let alone Money units. As for the calculation argument, I’ve already addressed it in my article. As an example, me borrowing 100 units of a Secondary Medium of Exchange called X means just that: I’ve borrowed 100 units of X from you which I must pay you back. As for whether I earn another Secondary Medium of Exchange called Y, convert it into X, then repay you, or I earn yet another Secondary Medium of Exchange called Z, convert them into X, then repay you, it doesn’t matter. What matters is that I repay you 100 units of X. What matters is for a calculation to be consistent in using only one Money for denominations; multiple unrelated calculations need not resort to any common monetary unit. I hope it makes sense.

My bad. I’ve now opted for a strict distinction between related terms where necessary and avoid generalization as far as I can. In retrospect, I can clearly see where I was mistaking. The Regression Theorem is all they have got in common. And the Regression Theorem applies to all Monies (i.e., all stuff being used as media of exchange). Besides that, they are different entirely! Their origins differ, their nature differs, their scarcity differs (hint: Bitcoin is scarcer), even their transaction mechanism differs. As for transactions, the nature of transactions, and the transaction costs associated with transactions, I’d love to add a few remarks.

Again, my bad. Representative-Money: [https://www.youtube.com/watch?v=_HR7ocy6eAE]

I’ve resorted to using strict terms with clearly defined definitions (though that requires assuming very high expectations from the reader; anyway, who cares if superficial people exploring this space from just the surface ever comprehend our terms…). Money Substitute is the term I use now. Thanks for pointing it out.

I’d love to distinguish between two types of transaction costs: the primary transaction costs, and the peripheral transaction costs. Their meaning should be self-evident. Gold has no (or infinitesimally negligible) primary transaction costs. Me handing you 1 kg bar of Gold transfers exactly 1 kg of Gold from to you. It has no primary transaction costs. It does have peripheral transaction costs that are way too high (imagine carrying a bar of Gold around, let alone storing it safely). Hence we used to use Gold Substitutes (claims to a particular amount of Gold) which had both low primary transaction costs and low peripheral transaction costs. Bitcoin has very high primary transaction costs. Me handing you Bitcoins requires the use of an intermediary (the Miner), thus Bitcoin has a very high primary transaction cost. It also has a high peripheral transaction cost (running a full node is expensive). Tokens represented as signed entries in Holochain (h)apps (such as Vril Tokens) have no primary transaction cost; all that transferring 10 units of X requires is for both the parties to engage in a handshake (i.e., countersigning). There are no Miners who must facilitate transactions of Holochain (h)apps that implement digital tokens. However, you’d be justified in saying that it too has peripheral transaction costs; for instance, both parties must expend electricity to engage in such a transaction. However, even transferring ERC tokens has no primary transaction cost, but it has a very high peripheral transaction cost (the fee you have to pay in Ether). However, Holochain Tokens don’t even have any significant peripheral transaction costs either (a Holochain app eats very low power and space). It’s low on both primary and peripheral transaction costs. Also, you’re right: the elimination of primary transaction costs (and the lowering of peripheral transaction costs) can make Holochain cryptographic Tokens go mainstream, something that Blockchain’s never could. Also, HoloFuel’s [which is the first digital token being implemented on Holochain, in case you didn’t know] 1% transaction cost does not serve any purpose, though they have listed many a great excuses for its introduction.

As a side note, I think you might be confused about burnability of Bitcoins. Bitcoins are never burned; the Bitcoin implementation, as it exists, doesn’t burn any part of its transaction fees. Though such a burning mechanism can be implemented relatively easily in the Blockchain space. Plus if you consider that people lose their keys, then yes, Bitcoin is deflationary, which is great for any Money to be (as it leads to resource allocation in real wealth-generating endeavors, ceteris peribus; we’re on the same page regarding that). However, as I’ve already argued, Bitcoin is not real Money; Bitcoin is a neutral Money, unlike Gold which is a Commodity Money. Sure, being neutral means devs like us get to implement deflationary mechanisms into it, but at what price? Having to keep a Money “neutral” so as to build into it a deflationary mechanism is a very big price to pay. Sure, from a Utilitarian perspective, all that should matter is the utility that such a society enjoys from a deflationary policy. However, even Mises, the great Utilitarian, has established that “neutrality of money” is logically impermissible; via argument a contrario, such a Money can only exist in an evenly rotating economy (i.e., a world of zombies; haha!). Hence I believe we should stop trying to invent a digital Gold and rather focus on making exchanges more efficient. That’s the only innovation worth pursuing in this fintech space; everything else (in cryptocurrency space) is a bluff! That’s what they (Art et al.) have got right about Money, albeit by chance. We (Holochain projects) should not be building Money, we should be building digital Money Substitutes of real Monies. Our digital tokens are not (and must not be) Money per se, rather they are Money Substitutes represented digitally. The AAA Monies that such Holochain Tokens should substitute are, in Misesian terms, the Secondary Media of Exchange (which includes all sorts of financial products such as Stocks, and even some special commodities such as Gold or Oil). We should not stop there; the goal should be radical tokenization of everything (including consumable goods) that brings the entirety of the financial industry accessible to all. Check out this illustration that speaks of some similar notions. Such radical tokenization, together equipt with a powerful and efficient exchange system (Vril’s rippling exchange system) should provide liquidity never seen before. Holding cash (and cash equivalents) provides the beholder liquidity. When liquidity is no longer a concern, cash (hence Money as we know it, including the sterile Gold that does not lay eggs) would not be deemed as worthy of possessing. Anyway, who knows how the future might unfold.

Anyway, that was my attempt at explaining all things Holochain, an explanation from an Austrian, to an Austrian. I hope you find it as helpful as I found your concerns in clarifying my state of mind regarding my understanding of (the peculiarities of) Money & Exchange over the past couple of months… If you find any fault in my conclusions, please please do let me know; I’ll be obliged (as I already am). Feel free to share your own personal opinions on Bitcoin (its neutrality, its future), on my distinction of transaction costs, on my so-sought dominance of Secondary Media of Exchange, on radical tokenization of commodities, of most asset classes’ assets, of equity (stocks), of consumables, and even of services (such as hosting), on my argument justifying my hesitation in advocating for embarking upon building ‘artificial’ deflationary mechanisms in code, and just about anything related. Your insights are highly valuable.

Bye. Gotta take a break from literature; haha!

– The A Man

I’m not sure who you are attributing the mentioned article to. It seems you are suggesting I wrote such an article, but I have never written any articles about HoloFuel on medium, and I hate those kinds of overblown titles “The World’s First…” and have tried to make sure they never come from anyone in this organization. But since I can’t find the article in a Google search or a search on medium, there’s no way for me to know who you are addressing.

However, you do specifically tag me suggesting your tip-off that I am trying to market fantasy crypto to gamblers is that I don’t understand banking, money creation, nor mortgage amortization schedules.

So, while I can’t comment on anything someone said in this supposed medium article, I can clarify some of these points.

If you are interested in learning how banking actually creates money, I’ll provide some proper references. And lest you think this some misinformed conspiracy theory blaming the wealthy, I will start by citing a paper published by a central bank. The following is a direct quote:

“This article explains how the majority of money in the modern economy is created by commercial banks making loans. … Whenever a bank makes a loan, it simultaneously creates a matching deposit in the borrower’s bank account, thereby creating new money.”

Bank of England paper entitled Money Creation in the Modern Economy

If you actually want to understand the strange accounting mechanisms by which this works, this paper traces the detailed approach by which banks perform this feat. One critical detail, is that banks do not list your deposits with them as a liability which they must repay to you (unlike would be done by your stock broker, for example) but as an asset which counts as their reserves in a fractional reserve banking structure. This is actually a known exception to standard GAAP available only to entities holding a bank charter.

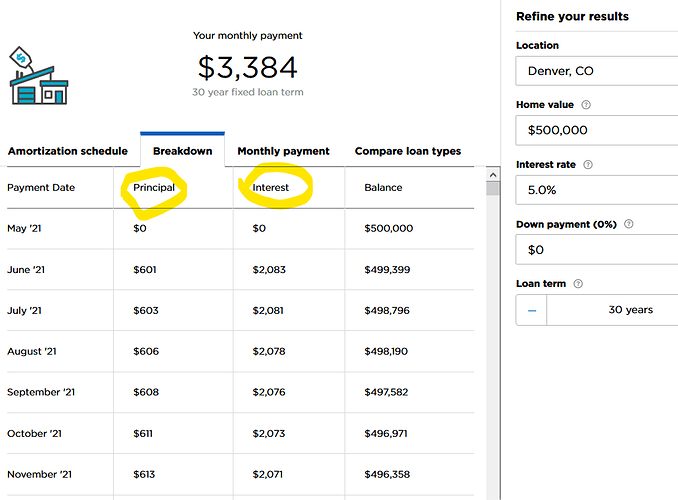

Okay, let’s look at the breakdown of mortgage payments (available on many online mortgage amortization tools such as the ones I included below.

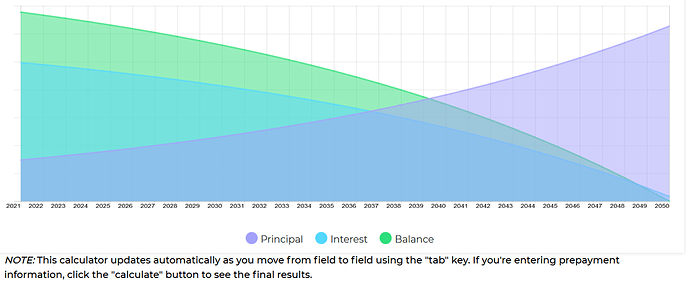

Note the blue vs. purple in the graph above. Note how much of your payment is interest(blue) in the beginning and how much is principal (purple) at the end. This is exactly as I described, front-loaded for interest, back-loaded for principal.

Here you can see the same thing spelled out in the numbers on the amortization schedule. They show that payments are most definitely NOT doing what you describe as paying mostly principal first – less than 20% of your early payments contribute toward repaying principal. And you can see by where the lines in the chart cross that it takes almost 20 years before the principal portion of your monthly payment exceeds the interest portion.

And as I already illustrated with the Bank of England paper above, it is exactly because they are not repaying some government entity. When you repay principal those dollars literally leave circulation, just as they came into circulate as the principal of your loan. The banks want the money they can keep/spend first, not the money that disappears and they have to make a new loan to create again.

In any case, it sounds like you think the banks borrow their money from the Fed. You realize don’t you the Federal Reserve is a private bank, owned by private shareholders, no more a government entity than Federal Express. And most the reserves that the Fed holds are actually contributed by their member banks. Anyway… this all works very differently than most people think or than how common sense might lead us to believe. But if you do some proper and sensible research it is all spelled out quite clearly.

Again, here you are saying it is MY medium article… and I’ve never written such a thing. I’d appreciate a link to whatever you’re talking about so we can find out if someone is pretending to publish under our authority. Sorry I can’t take responsibility for any rhetoric in that article.

However, I don’t agree that BTC or ETH or such are ponzi currencies the way that USD is. USD is issued by banks as debt which bears interest, and we have to issue more next year to service the compounding interest on what we issued this year. If banks need to make more loans to issue more USD, then we need to grow the economy to justify more lending. And note, all Ponzi schemes collapse when they reach their limits of growth.

BTC and ETH and many other cryptos have a different dynamic. They are certainly not issued as debt with compounding interest. But they have a whole other problem of speculative market dynamics where the ignorant get trampled by the whales in their pump and dump cycles… and to keep the price rising you need need to keep attracting more investment which means more innocents who often get trampled. But that’s a dynamic of being untethered from any clear value (not backed by hosting, for example) which has nothing to do with USD pattern of ponzi growth.

If you want to understand how HoloFuel having a net ZERO supply, where the active supply can both expand and CONTRACT based on real market dynamics is different than a steadily growing supply then I’d recommend reading the Holo Currency White Paper

Most of The-A-Mans assertions about HoloFuel and how it works are not accurate (a few parts are close though) but dialogue with him has generally proven too exhausting to try to clarify functional points, when he’s really arguing veiled ideological points. So I largely gave up on doing so in this thread. I do believe he is committed to his vision, he has shown good faith that he is learning things along the way, and he has published a few later corrections, so maybe it could be worth engaging again.

https://medium.com/h-o-l-o/holo-fuel-economics-101-c9631d63014a says:

First is the actual hosting price offered to publishers or applications on the network. This price is denominated in HoloFuel.

…

The HoloFuel price is the price to buy/sell a unit of HoloFuel on either exchanges or reserves.

The purchasing power of HoloFuel is primarily impacted by internal competition and supply dynamics.…

However, this increase or decrease in hosting price does not automatically translate into fuel price movements.

Also, this medium article was written in collaboration with Art Brock, Mary Camacho, and David Atkinson (of whom only @artbrock is on the forum). [EDIT: Whoops! Looks like others are too; cc @marycamacho, @alastairong.]

In short, my owning a hundred units of HoloFuel doesn’t translate to me being able to redeem them for 100 units of Hosting (for example, 100 hours of hosting). That is surprising, no? Especially when Holo has been so vocal about how HoloFuel will be backed by Hosting.

Also, I’d have linked the youtube video too (https://www.youtube.com/watch?v=5DS23TMiVrQ) which mentions an equation that goes like purchasing-power (in hosting-units/$) = HoloFuel price (in HF/$) * Hosting price (in hosting-units/HF), but sadly, it got taken private a month ago!

So, the natural question follows:

On what grounds do you say HoloFuel is backed by Hosting?

Clearly, you’re all using the word ‘Backing’ (besides the word ‘Stability’) in a completely hypocritical sense! “Being able to be redeemed for” is not what you mean by “backing”, do you?

The Shortest Possible Yes/No Question:

Isn’t HoloFuel more like Fiat than like the Gold Standard?

Fascinating if this is the article that @noclue was referencing. I don’t see any claims in about being the “Worlds First Digital Stable Asset” or about anything else being ponzi schemes, or any of the rhetoric he’s saying was used.

I didn’t realize this article was published attributing me (or other nan-authors of it). I reviewed the slides in the slide deck as not having any glaring inaccuracies or anything that would get us in trouble with regulators, but the narrative text about the slides is Alastair’s, not mine.

In any case, let’s get to your fundamental question:

I wonder if you’ve ever been to a farmer’s market where the farmers don’t have the portable electronics for processing credit cards so there’s a booth where you can purchase “tickets” on your credit card and then go spend them with the farmers. There’s no question as to whether the tickets are redeemable for food, even though there is no single food unit they are necessarily equivalent to. Farmers price their food as they normally would… sometimes by weight, by volume, or by count. The fact that a ticket isn’t equal to a specific food unit doesn’t mean tickets are not redeemable for food.

Another example is a stock photo site where you need to purchase photo credits (largely because the site can’t afford to pay credit card fees on a bunch of $1.50 purchases so they make you buy at least $20 of credits that can be used toward photos). These photos are not all the same price, in fact, they change based on size/resolution and usage rights that you’re requesting as well as by other factors that I don’t know all the dynamics of. But there is no confusion as to whether the photo credits are in fact redeemable for photos.

Similar to the farmer’s market, delivering hosting is not a single unitary element. There are different patterns of usage by apps which place different burdens on the resources of hosts. A CGI graphic rendering app may be extremely compute intensive. A YouTube like media service may be extremely storage intensive. A real-time collaborative game or editor may be bandwidth intensive without storing or computing much. For us to force hosts into some kind of one-size-fits-all pricing structure because of the way you’ve defined “sane money” is not actually a sane business model.

Also, the cost of hosting can be very different for different hosts. Maybe you live in an area with cheap access to Gigabit fiber while others have expensive, slow and metered bandwidth. Or maybe you live in a place with free/subsidized electricity for compute power. How is it sane for us to a global standard unit price for those things? Isn’t that like the nonsense of the government forcing farmers to sell food at a fixed per pound price leading to horrible side-effects like everyone just growing potatoes to maximize dollars per pound? Enabling hosts to set their own prices for bandwidth, storage, and CPU time lets the real market benefit from real differences and enables hosts to set prices appropriate to their actual costs to continue to provide hosting.

Despite the real world fact of differences in unitization of Mb/s, Mb/week, milliseconds of CPU usage, there is no question that HoloFuel units are redeemable for hosting. In fact, that we enable pricing of these different dimensions of delivering hosting is exactly what makes it work.

On the side of using hosting, an app provider can profile their app to see how much CPU / storage / bandwidth they expect it to use. Then they can configure their host matching filters and thresholds so that we can show the current pricing statistics for correlated hosts such that they can estimate the HoloFuel costs of powering their app. This shows how far their 100 units of HoloFuel will go – which is what it means to have this currency backed by hosting.

In Vril, are you saying a farmer must have a single unitary currency even though they may sell flowers, zucchini, raspberries, and chicken? These all must be one price per gram? Or they must have different Vril units for each of their foods multiplied each of their measurement units? You certainly aren’t making Vril very usable if this is the scenario. I don’t see any farmer ever being willing to manage all that pricing configuration and navigate changing market dynamics for pricing that many products and unit metrics. Nor will buyers be keen to figure out the relative values between corn credits by weight vs. corn credits by ear vs. corn credits by kernel vs. corn credits by liter. It seems like you need some usability testing before you go attacking a system just because it doesn’t match the expectations of your ideological absolutes because it is designed to make things actually work for all parties involved in the frame that is familiar enough for them to use it.

You building logical fallacies into your definitions does not make us hypocrites.

The answer to your shortest possible Yes/No question is that you’ve created a false dichotomy – a mistake in your assumptions that forces both a yes or no into your broken frame, akin to “Is the reason you have no friends because you’re still lying to them about the money you stole from them?”

That’s just a simple yes/no question, right? No weird assumptions baked into that question at all, right?

Fiat: HoloFuel is never created from nothing… so it is fundamentally unlike fiat. The total supply of HoloFuel is always zero. Zero supply in fiat means no currency units exist. So no… it is not at all like fiat.

Hosting is not priceable in a single unit like ounces or grams so it is not as simple as a Gold Standard. However, host prices in the appropriate units are pre-published by the host, and made visible using estimation tools, and HoloFuel is redeemable for hosting at those prices.

So it’s a lot closer to a Gold Standard if you need to measure some kind of “distance” from currencies that you are familiar with.

Not as satisfactory a response as I anticipated… Anyway, thanks for taking the time to respond. It’s much appreciated. Again, I do not wish to waste your precious time; I’m genuinely interested in being able to define HoloFuel properly (as part of my knowledge-seeking endeavour around all things Money; thus far, HoloFuel seems to be the most complicated thing I’ve come across, for better or worse…)…

A few things to clear:

I wasn’t saying that that was the article NoClue was talking about. I was just mentioning the contradictions I could spot in HoloFuel’s design (documents); I myself asked NoClue to reference the article he was talking about.

Another thing: the contradictions I’ve spotted in Holo’s statements have nothing to do with Vril; they are totally different subjects. Though I’ve already explained at length how HoloFuel could just as well have been modeled in Vril.

As for tickets:

Those tickets are BACKED by, let’s say, Dollars. That’s the point. At the end of the day, even if I found no interesting vegetable/fruits in the market, I can redeem my tickets for Dollars. That’s not what HoloFuel is (just the fact that HoloFuel’s price can fluctuate against the Holo reserve currency should be enough to prove this assertion; which is why you have the LIFO mechanism in place, no?); yet that’s what most people here assume it to be. Clearly, you are all mis-guiding innocent people into thinking that HoloFuel tokens are digital credits (i.e., pegged against Dollar or whatever). In fact, if that’s what they were, I’d call Holo a private bank that keeps Dollars as its reserve and issues digital Money-Substitutes that are easier (or rather, way easier) to transfer than the hard physical cash. In fact, I’d have been very happy with HoloFuel’s design were that the case…

The total supply of fiat too, as you have yourself pointed out earlier, is absolutely zero! Every dollar is backed by equal units of “liabilities” in the bank’s statements. [Though I don’t know the intricacies…] And at the end of the day (ignoring the contractual interests to be repaid, hence begetting further borrowing), all fiat monetary units can be cleared. Also, even Fiat is not created from “nothing”. Someone has to go in debt so as to create the Dollar, no?

Though I never though about it (and always assumed that it should be your task to figure this out), now when I think of it, maybe you’re right here… But what about a package that includes {1 hour of {1 GHz CPU, 1 GB RAM, etc}} and another with different configuration, and so on. Plus, as far as I know, all HoloPorts are the same! Even better! So clearly, 1 unit of Hosting of a particular flavour of Hosting can be defined, albeit arbitrarily.

Also, you seem to be confused about the two terms: being “backed” means being redeemable (1 to 1) against the said thing that it backs, versus being able to be “bought” against simply means that you can buy something with it. “Back”-ability (or rather, redeem-ability) is different from “bought”-ability. Fiat, much like Holochain, is not backed by anything; but you still can buy all sorts of things with Dollars. Gold Substitutes (those kept by bullion banks and issued as digital tokens) are strictly backed by the corresponding amount of Gold; Gold may become worthless someday (making you unable to buy anything with it) but you’d always still be able to “redeem” your tokens with real Gold. HoloFuel is clearly fiat issued privately. If 1 unit of HoloFuel were to be truly backed by 1 unit of Hosting (as described above on what that might be), the HoloFuel note would say “I represent 1 unit of Hosting; the unit of Hosting means {1 hour of {1 GHz CPU time, 1 GB Ram time, etc}}”. Such a HoloFuel would be a proper Money-Substitute. If 1 HoloFuel is pegged by 1 unit of some other Money, it would be as good as that Money that it’s pegged against. However, 1 HoloFuel (as it exists) is neither pegged against some other Money (such as Gold, Dollar, etc), nor redeemable for 1 exact unit of Hosting; it’s like the Fiat money that banks create.

The core question remains. To repeat, the equation a * b = x has infinite solutions (even when x is a given, such as in the total hosting capacity available to Holo). You can issue very few HoloFuel tokens and have them be priced ridiculously high or issue many tokens and have them be priced cheaply. Thus, in a sense, you the Holo Organization control (or rather, would control) the price of HoloFuel. Isn’t it true? Again, I have not the slightest of doubt regarding your intentions; the question is purely epistemological.

Okay @The-A-Man, I guess the problem is that you still believe a lot of the mistaken things you’ve asserted about HoloFuel, so for your sake and for the sake of others now confused by them…

HoloFuel Corrections (1 of 6)

@The-A-Man puts forward his “stripped down” explanation of HoloFuel as if it is authoritative. While he gets a couple things right, overall it is pretty inaccurate, and laced with ridicule rooted in his ideological bias about Vril.

But since this thread is public and others seem to take his criticisms seriously, I guess I need to provide some corrections here.

[[Note: A consistent mistake @The-A-Man makes is to project Holo’s involvement in everything – every transaction and in the allocation of every unit of currency.]]

There is no central allocation of credits happening in HoloFuel. However, there are 4 types of credit limits for accounts in HoloFuel. (L for Limit)

-

Basic/General Users: L = 0

-

Holo: L = 177,619,433,541 (# of credits created in the ICO)

-

Reserve Accounts: L = balance of deposits in the bound external currency account (at the price at which the HoloFuel was originally purchased)

-

Hosts: L approximates to: for time window, average(Tx) * #Tx * #Unique_counterparties * Available portion (a simple formula derived from their last 3 months of hosting activity, with minor adjustment to make gaming of credit limits difficult)

That’s it. No centralized allocation or control of credits. Only transactions between peers with simple formulas for calculating credit limits.

So let’s look at the claim about the [complexity class] of the problem and time complexity of the computation of a credit limit.

-

General users = O(1) constant time

-

Holo = O(1) constant time

-

Reserve = O(n) linear time to compute a simple running balance in a single pass

-

Host = O(n) linear time for a single pass on one host’s local source chain to collect the variables for the formula

So the complexity class is so far below polynomial that it generally doesn’t even show up on the map of important complexity classes (because it is considered simple not complex), much less reaching NP (non-deterministic polynomial) or exceeding it.

Not to mention nobody ever has to compute ALL of these credit limits. Validation of a transaction typically won’t involve ANY credit limit computation because they typically won’t involve a negative balance (except where the spender is Holo or a Reserve).

To get a sense of the actual scope of the problem, let’s examine a busy host, with lots of bandwidth hosting 100 happs and billing daily. Over the span of 3 months that will be about 9000 transactions in their source chain. (Note: Their credit limit doesn’t need to be computed for any of those transactions because they’re RECEIVING payment for hosting, and the app provider paying them doesn’t have a credit limit.) Now suppose a host wants to SPEND some of their earnings to buy a Tesla with HoloFuel (since this is the first time a credit limit computation will even come into play). How long does it take to count those transactions, average their size, and count the unique counterparties? Likely less than 1 millisecond, even on a Raspberry Pi.

To confuse these simple calculations with a computation problem so difficult that it requires beyond polynomial time is to demonstrate that you don’t understand how the HoloFuel works.

It seems this stems from @The-A-Man’s frame that the Holo organization is some kind of central controlling puppet-master, and because he embeds this false assumption underneath all of his understanding of HoloFuel, he keeps manufacturing strange interpretations that are not only inaccurate but outrageously complex and upside down.

Oh yeah, I was wrong about the NP claim; I admit. My bad.

## HoloFuel Corrections (2 of 6)

In an actual complex system (like a hosting marketplace), thinking in linear sequences instead of feedback loops which can be entered at any point in the loop is the first mistake here. For example, the app provider/publisher may well have acquired fuel for paying hosts long before any hosting was performed.

But okay, let’s start where @The-A-Man chose to start with the host providing hosting. Yes, a host provides hosting before they get paid for it. That is the only accurate statement in his paragraph.

Hosts service web browser requests until they reach whatever billing/risk threshold they’ve configured in their settings (e.g. provide up to 2.5 HoloFuel billing units of hosting power before sending an invoice) This invoice functions as a “Proof of Service” which contains the security token allowing the payor to access the segment of signed hosting logs that is being invoiced for.

======================================

Brief pause to clarify roles and what they’re called since @The-A-Man plays pretty loose with terms.

-

An app developer writes software – the back-end DNA of a Holochain app and/or the app’s UI. They might not at all be involved in paying hosting fees for the app. Consider the example of a wiki or slack-chat style app, different groups are going to pay the hosting fees for their own community wiki or company chat to be served to their web users, just like the developers of MediaWiki don’t pay the hosting bills for your wiki.

-

An app provider is the one who pays the hosting bills to have an instance of a Holochain app be accessible to web users.

-

A Holochain user runs an app on their own machine and therefore doesn’t need hosting.

-

A web user has likely never heard of Holo or Holochain and just wants to type an address into their web browser to reach a web app.

-

A Holo host provides the computing power, storage, and bandwidth to service requests from web-users such that they can access the same kind of experience that a Holochain user can. Hosts get paid in HoloFuel for providing this bridge to mainstream web users.

-

Holo is the organization that keeps all this infrastructure running – the centralized aspects like DNS and routing, updates and tech support for host devices and software, and provides the funding for the app store, dev tools, and Holochain as the underlying infrastructure.

Identifying any one role as “the consumer” fails to recognize that everyone is consuming different things from each other in this ecosystem. Web users consume site content from each other and hosting service from Hosts, who consume hardware and software from Holo, who consumes distributed data integrity software from Holochain, who consumes a portion of the transaction fees paid by app providers, who consume custom apps from app developers, who consume dev tools from Holochain and Holo… and so on.

======================================

Continuing with the payment cycle above… When the app provider receives an invoice, they use the security token it contains to harvest the signed service logs (requests signed by web users, and log entries signed by host). They pass the logs through a fraud detection system to make sure the traffic being billed for is legitimate, and then they pay the invoice (and accrue a 1% transaction fee owed to Holo as part of the transaction record).

Eventually they’ll hit a threshold where nobody will transact with them unless they pay the transaction fees they owe. At that point they commit an entry to their source chain which parks a fee payment in a fee payment box on the DHT. Holo periodically collects parked fees from those boxes. Holo is never party to transactions between HoloFuel users unless you happen to be transacting with the Holo org directly.

That’s actually the complete hosting cycle. Hosts don’t go into debt in the process of hosting. App providers don’t have credit limits so they can’t go into debt in HoloFuel (meaning have a negative balance). App providers could have acquired their credits in many ways (earning them from providing hosting, purchasing directly from a host, converting from HOT or a “filthy” national currency through a Reserve Account, purchasing them on an exchange, etc.) Holo doesn’t “mint” HoloFuel to pay the host and then later collect from the app provider, or any of that nonsense.

Also note that Holo does not plan to provide Reserve Accounts for BTC or other “Gold-like” currencies. They are too volatile to maintain reasonable pricing dynamics for our Reserve Accounts. So far, we expect the HOT Reserve Account will serve as our bridge to the world of hyper-volatile cryptocurrencies.

Thanks! That’s much more precise. Though I’ve already read it all in the whitepaper…

## HoloFuel Corrections (3 of 6)

There’s a lot of feisty language in that paragraph, but nothing accurate. App providers are not in debt to Holo (as in negative balance), they have to acquire their HoloFuel to pay hosts from somewhere, but this is no different than anyone needing to pay bills in any currency. Maybe you want to call invoices they are receiving from hosts “debt”, but I think that is confusing the matter, the invoice may be fraudulent and the host may be reported for fraud, it is simply an invoice for service, you could call it Accounts Payable, and in that accounting sense it is a liability. But who runs a business without accounts payable and receivable? And why is the @The-A-Man turning the act of trading into an attack on HoloFuel?

Also, there’s no reason to insult hosted web users. Some may even be Holochain users who are traveling and away from their hardware that’s running Holochain. If we want decentralized systems to get taken seriously and go mainstream, we have to be able to serve mainstream users. This is a major barrier that blockchains have not overcome because of the hurdles involved in acquiring crypto to pay gas fees before you can engage with a blockchain.

This certainly shows he can only be talking about debt as negative balance because sending an invoice never changes a currency supply. The cell phone company doesn’t borrow money to send you your bill. And receiving a bill certainly doesn’t mean receiving the money to pay it.

So… just wrong here.

This seems to just be a projection of some kind of agenda about “modeling HoloFuel as an asset.” We actually model HoloFuel as simple accounting for peer-to-peer transactions.

The “asset” we refer to that backs HoloFuel is hosting power.

## HoloFuel Corrections (4 of 6)

This is just all kinds of confusion.

Host’s don’t “go into debt first.” In fact, host credit limits won’t even be available until the hosting network has operated for a number of months. Hosts provide hosting service, then invoice an app provider for it. Simple.

Again… projecting onto Holo some process of complicated “assessing prowess” and “minting” currency.

I think he’s confusing the fact that once host credit limits are active, if a host wants to SPEND HoloFuel on something (like a Tesla Powerwall to keep hosting during power outages), they may want to spend more than they have in their balance and draw on their credit limit. (You can think about this as similar to an interest-free overdraft loan on your checking account.) They have a hosting history that everyone can see to perform the calculation I described in a previous post which determines whether they can ‘overdraft’ that amount.

Holo is not involved in that transaction. Every node can do this computation for themselves. Hosts are never forced to go into debt. There was no other act of minting. A host only spends credits on something they want. Spending into the negative IS the act of issuing new currency in a mutual credit currency like HoloFuel, so if you want to say someone is “minting” something, it is the host that is doing so.

HoloFuel Corrections (5 of 6)

Finally, we have another part of a sentence that actually correlates to something that happens in HoloFuel before it goes off the rails again.

TRUE: Hosts can redeem HoloFuel via Reserve Accounts (like HOT, USD, EUR, etc.) that they have received as payment for hosting invoices.

TRUE: The price they can redeem from HoloFuel to an external currency is the same price as someone bought HoloFuel in that currency. And hosts get the most current market price (LIFO).

Unfortunately, the rest goes sideways.

There is no voting or politics in setting the price. There is an algorithm for setting prices in each outside currency that people can buy HoloFuel from a Reserve Account. We derive most the inputs to that algorithm from hosts (their actual behaviors in redeeming currencies, which reserve currencies they redeem to, at what prices, their hosting settings about the currencies they want to redeem to, at what minimum price, etc.).

Let’s be clear – Holo is a hosting business. It does us no good to sell hosting services for less than our network of hosts will provide service for. Therefore, Reserve Prices are driven by host data and will converge toward the actual costs involved in providing hosting. How do we know that? Because people won’t sustain hosting at a loss, and since we provide consumer-grade / plug-and-play devices for hosting, if they charge too much, then new players will happily jump in to increase hosting supply which forces hosts to choose competitive pricing to attract any traffic.

This is where he totally gets the last part wrong. Hosts don’t set their prices in Dollars, Euro, or HOT. They can’t change those prices. They set their prices for bandwidth, storage, and processing in HoloFuel. And if they set their prices too high, then the matching algorithms which set up the routing patterns to match the needs/priorities of app providers to hosts, won’t route any traffic to them, so they won’t have any credits to redeem at any Reserve Price.

A host can’t start at a negative balance.

A host can only REDEEM credits they actually have at a Reserve Account (from a positive balance). A host can SPEND their credits however they like to go negative – but they can’t also redeem the credits they’ve already spent.

This part isn’t so far off-base if he wasn’t using negative numbers in the balances. He is suggesting Holo has flipped this all upside down, but it seems to be an inversion of his invention.

Precisely!

If that were true, you could simply have created Holochain digital Money-Substitutes of Dollars (or whatever), i.e., a currency pegged against the Dollar (or Gold, or Bitcon, or whatever) and have used your digital tokens to power the microtransactions Holo requires, which the Blockchain systems, for instance, are inferior at powering.

How do you reply to this?

That’s all that interests me basically; and you’re just saying “once credit limits are active, blablabla…”! Isn’t that process, the process of granting credit-limits, the one that requires KYC, the hardest task?

HoloFuel Corrections (6 of 6)

We never ask you to fight against anyone. Not against national currencies. Not against blockchain currencies. Not against surveillance corporations. Since those things will collapse under their own dysfunction, nobody needs to waste energy fighting them. We are focused on building viable, functional alternatives. He is projecting his fight onto us and telling us we’re not doing it right.

Again… upside down. Holo has a negative balance (at least until we’ve earned enough transaction fees to pay it back, which may not even be possible if the value of HoloFuel rises). And Holo isn’t minting anything in any of the places he has suggested. The only time Holo issues currency is when it SPENDS into the negative against its credit limit.

He is still projecting some kind of complex puppet-mastering of allocating credits and assessing prowess. The basis for determining whether a host is likely to be able to repay a negative balance is to perform a calculation on their past few months of hosting as a projection of their next few months of hosting. This is neither difficult or unjust.

And besides, Holochain already provides the completely decentralized solution with no payments required!!! Just use that if you don’t like Holo trying to make sure prices align with the needs of hosts. Then you can also go figure out your own way to reach mainstream users.

HoloFuel is not trying to be the one, perfect, righteous, and fair currency that solves all tragedies of the commons and economic injustice on the planet. HoloFuel is for running a hosting business and providing an example of a truly P2P, secure, anti-volatile currency that can operate at speeds and scales that blockchain can only dream of.

That is value enough from HoloFuel because it will enable many more currency variations to be built on Holochain which can tackle some of those other problems that HoloFuel doesn’t solve.

I’m inclined to stop the corrections to this lengthy post about HoloFuel here because all the later assertions are built on the mistakes of the earlier assertions plus some other bizarre notions (like DNA-sequencing is the only defense against Sybil Attacks).

@The-A-Man, I don’t mean any of these corrections as an attack, but since this thread does show up in Google searches and based on responses below your story, some people are taking this critique seriously, I needed to address the inaccuracies about HoloFuel. I would have preferred to just let all this slide as part of your early learnings here.