I’m not sure who you are attributing the mentioned article to. It seems you are suggesting I wrote such an article, but I have never written any articles about HoloFuel on medium, and I hate those kinds of overblown titles “The World’s First…” and have tried to make sure they never come from anyone in this organization. But since I can’t find the article in a Google search or a search on medium, there’s no way for me to know who you are addressing.

However, you do specifically tag me suggesting your tip-off that I am trying to market fantasy crypto to gamblers is that I don’t understand banking, money creation, nor mortgage amortization schedules.

So, while I can’t comment on anything someone said in this supposed medium article, I can clarify some of these points.

If you are interested in learning how banking actually creates money, I’ll provide some proper references. And lest you think this some misinformed conspiracy theory blaming the wealthy, I will start by citing a paper published by a central bank. The following is a direct quote:

“This article explains how the majority of money in the modern economy is created by commercial banks making loans. … Whenever a bank makes a loan, it simultaneously creates a matching deposit in the borrower’s bank account, thereby creating new money.”

Bank of England paper entitled Money Creation in the Modern Economy

If you actually want to understand the strange accounting mechanisms by which this works, this paper traces the detailed approach by which banks perform this feat. One critical detail, is that banks do not list your deposits with them as a liability which they must repay to you (unlike would be done by your stock broker, for example) but as an asset which counts as their reserves in a fractional reserve banking structure. This is actually a known exception to standard GAAP available only to entities holding a bank charter.

Okay, let’s look at the breakdown of mortgage payments (available on many online mortgage amortization tools such as the ones I included below.

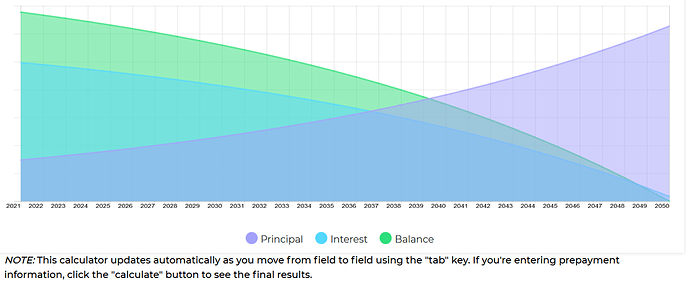

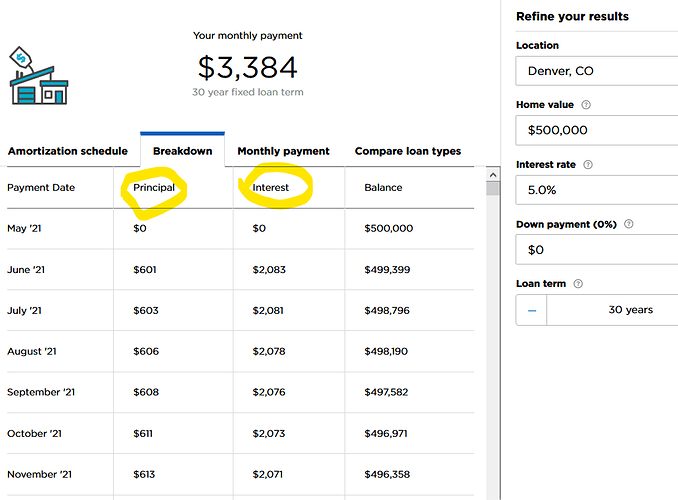

Note the blue vs. purple in the graph above. Note how much of your payment is interest(blue) in the beginning and how much is principal (purple) at the end. This is exactly as I described, front-loaded for interest, back-loaded for principal.

Here you can see the same thing spelled out in the numbers on the amortization schedule. They show that payments are most definitely NOT doing what you describe as paying mostly principal first – less than 20% of your early payments contribute toward repaying principal. And you can see by where the lines in the chart cross that it takes almost 20 years before the principal portion of your monthly payment exceeds the interest portion.

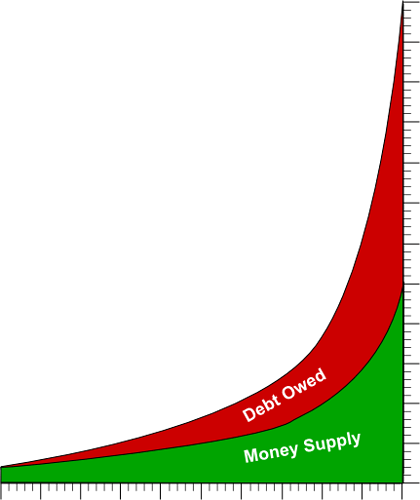

And as I already illustrated with the Bank of England paper above, it is exactly because they are not repaying some government entity. When you repay principal those dollars literally leave circulation, just as they came into circulate as the principal of your loan. The banks want the money they can keep/spend first, not the money that disappears and they have to make a new loan to create again.

In any case, it sounds like you think the banks borrow their money from the Fed. You realize don’t you the Federal Reserve is a private bank, owned by private shareholders, no more a government entity than Federal Express. And most the reserves that the Fed holds are actually contributed by their member banks. Anyway… this all works very differently than most people think or than how common sense might lead us to believe. But if you do some proper and sensible research it is all spelled out quite clearly.

Again, here you are saying it is MY medium article… and I’ve never written such a thing. I’d appreciate a link to whatever you’re talking about so we can find out if someone is pretending to publish under our authority. Sorry I can’t take responsibility for any rhetoric in that article.

However, I don’t agree that BTC or ETH or such are ponzi currencies the way that USD is. USD is issued by banks as debt which bears interest, and we have to issue more next year to service the compounding interest on what we issued this year. If banks need to make more loans to issue more USD, then we need to grow the economy to justify more lending. And note, all Ponzi schemes collapse when they reach their limits of growth.

BTC and ETH and many other cryptos have a different dynamic. They are certainly not issued as debt with compounding interest. But they have a whole other problem of speculative market dynamics where the ignorant get trampled by the whales in their pump and dump cycles… and to keep the price rising you need need to keep attracting more investment which means more innocents who often get trampled. But that’s a dynamic of being untethered from any clear value (not backed by hosting, for example) which has nothing to do with USD pattern of ponzi growth.

If you want to understand how HoloFuel having a net ZERO supply, where the active supply can both expand and CONTRACT based on real market dynamics is different than a steadily growing supply then I’d recommend reading the Holo Currency White Paper

Most of The-A-Mans assertions about HoloFuel and how it works are not accurate (a few parts are close though) but dialogue with him has generally proven too exhausting to try to clarify functional points, when he’s really arguing veiled ideological points. So I largely gave up on doing so in this thread. I do believe he is committed to his vision, he has shown good faith that he is learning things along the way, and he has published a few later corrections, so maybe it could be worth engaging again.