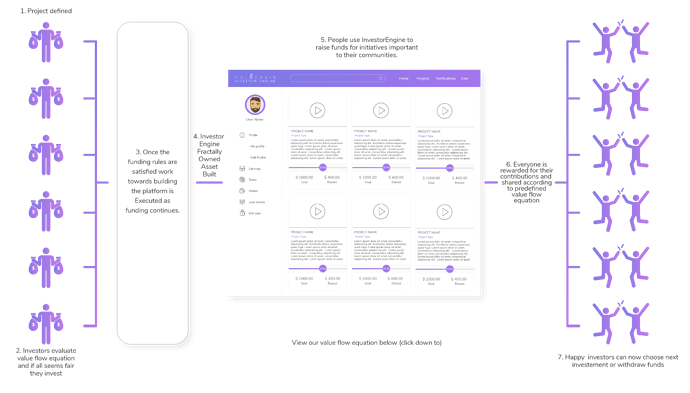

We are solving the funding issue.

The problem:

- Current securitisation processes are flawed which is why we have a global banking system that lacks integrity.

- Funding of new projects is a struggle for people who are trying to build businesses that don’t exploit nature (however that looks like for you).

Goals:

- To enable more investment to stream into holochain ecosystem.

- To bridge the gap between the traditional world and the new web3 world.

- To enable funding to startups building on holochain through asset securitisation (this is how banks fund themselves).

- To enable end-to-end transparent asset securitisation for managing the commons (however that looks like for you).

- To enable investors of value to feel safe knowing they have legal ownership status of assets which are protected by the state, allowing holochain to legitimise their activities in the finance industry and rapidly into the next market of adoption.

- To allow institutional investment to flow into these investments.

- To enable us to build the core asset securitisation processes of a Transparently owned and run “Deposit Taking Institution” in Australia… In other words (A normal bank built on Holochain) our law firm is about halfway towards this goal of evolving into a bank self-regulated by https://www.apra.gov.au/

- To enable regionally owned/commons managed ISPs running on Holochain (I spent a year building a startup ISP which did very well) but we now want to take this for-profit ISP model and evolve it into a transparent commons model. Comms should be free or cost price, not held hostage by for-profit greed.

Project Status:

- We’ve built a first pass of the announcement website at: InvestorEngine.org under password protection (username: user Password: valueflow )

- We are building an Investment Portal that will eventually allow investments to be made and profits to be withdrawn, this is enabled by our financial services law firm: https://www.nxt.legal/

- Our MVP will be live in September with MongoDB backend until Holo goes live. Then we move over to HoloREA modules and will allow projects to list, and collect Expressions of Interest. Since this forum has launched we will encourage people to refine their idea in the water cooler chat before collecting official expressions of interest.

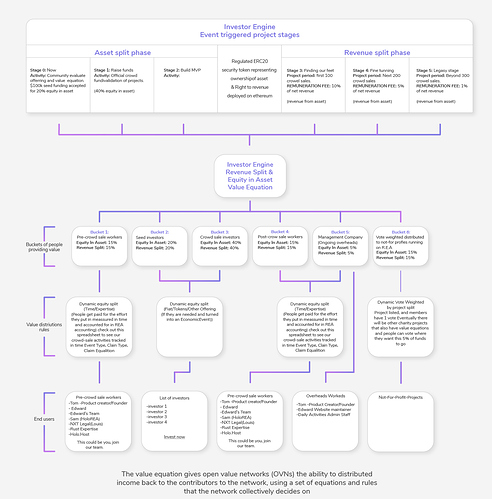

Asset Securitisation Processes:

- This is a very practical real world implementation of the brilliant work Lynn and Bob have done at https://valueflo.ws and Sensoria’s Buckets of Value: https://speakerdeck.com/mikorizal/1-nrp-overview?slide=31 If you are not aware of Sensoria’s work it’s worth studying these slides: https://speakerdeck.com/mikorizal

- We think different buckets of value that get returned by an asset will have different securitisation rules depending on the context and the people who feel they have claims to that bucket.

- We envision investors are rewarded with a limited profit for putting the funds up and subject to risk and enforced by value flow equations, before assets eventually become managed by the commons.

- We are not clear on our securitisation processes even for InvestorEngine (as a peer owned asset).

- We have created a suggested value flow equation that splits assets and limited dwindling revenue rights into different buckets. As per the image below.

But are still unsure how each bucket should split equity.

Questions to the Holochain Community

e.g

Buckets 1 and 4: Work done by Crowd-sale workers

- Equity in Asset: 15%

- Limited Revenue Split: 15%

How should these two bits of value flow be split to individuals who have claims to these buckets?

- We are suggesting we track time or award Equity and Revenue rights based on time spent, but what about people who have expertise?

This is where we want to work with the community to work out if we should be creating sub engines like:

- Dynamic Equity split Engine based on time

- and Dynamic Equity split Engine based on time and expertise powered by @philipbeadle’s Persona hApp, making use of Composable Credentials, Claims, and Assertions.

Buckets 2 and 3:

- Equity & Revenue split based on funds invested to pay for development of the platform.

- Traditional equity split at this point.

Bucket 5:

Should there be a driver bucket (Bucket 5) owned by a management company that drives the execution of the project?

If not what other solutions are there to for someone to be responsible to drive the project forward?

Should there be a Bucket 6 that just flows value into other projects building on HoloREA to build the ecosystem?

Basically these buckets need to scoped up and equiped with different measurement methodologies that would govern equity and revenue rights, but at the same time the projects be measured by frameworks such as MetaImpact Framework: https://www.metaintegral.com/

We want to float these ideas in this thread and tighten down the design of these Equity Split Engines and tie up all the loose ends before we refine the project home page and announce it to the world.

We also want to work open and collaboratively with you and discover what works for you to feel motivated to work on this project or a project designed to be an Open Value Network.